Ostomy Products Manufacturing Market 2025-2030

Table of Contents

The global ostomy products manufacturing market size is estimated at 4.1 billion US dollars in 2025 and is expected to reach 5.3093 billion US dollars by 2030, with a compound annual growth rate of 5.5% from 2025 to 2030. The demand for Ostomy Products Manufacturing is expected to increase. This is mainly attributed to the increase in the number of patients with urinary system diseases such as bladder cancer and colorectal cancer, the increase in the number of stoma surgeries, technological advancements, and the improvement of ostomy care concepts. This article will bring you a detailed analysis of the Ostomy Products Manufacturing Market from 2025 to 2030.

Overview of Ostomy Products Manufacturing Market

1. What is Ostomy Products Manufacturing?

Ostomy bag is a medical device specially designed for patients undergoing stoma surgery, used to collect the excrement discharged from the stoma. When there is inflammation, cancer or trauma in the patient’s intestines or anus. If the patient is unable to defecate normally, the doctor will connect a part of the patient’s own colon to the abdominal wall and make an incision in the abdomen. Feces can be discharged into the colostomy bag through the stoma. The ostomy bag can collect the excreted feces and urine, effectively protect the skin around the stoma, and help patients maintain personal hygiene and cleanliness for a long time.

The composition of Ostomy Bags:

- Bag body: Ostomy bag body is usually made of transparent or opaque soft materials and is used to collect the excrement discharged from the opening. It features strong leak-proof performance, strong odor resistance, and skin-friendly softness.

- Skin barrier: Basically made of hydrocolloid or silicone material, it is adhered around the stoma skin to fix the bag body, which can prevent excrement from contaminating the skin and prevent leakage.

- Discharge outlet: The discharge outlet is usually located at the bottom of the Ostomy bag. The open discharge outlet can discharge loose or liquid waste, which can be emptied, cleaned and reused.

- Ostomybag accessory: Activated carbon filter, which can absorb odors and prevent them from leaking. Leak-proof rings and leak-proof paste are used to achieve stronger sealing and adhesion, preventing leakage and odor.

2. Ostomy Products Manufacturing Market Size & Forecast

The market size in 2024 is approximately 3.2 to 3.5 billion US dollars.

It is expected that the CAGR will remain between 4.5% and 6.8% from 2025 to 2030.

It is expected to exceed 4.5 to 5 billion US dollars by 2030.

Growth drivers of Ostomy Products Manufacturing Market:

- The incidence of intestinal diseases such as inflammatory bowel disease (IBD) and colon cancer continues to rise.

- The aging of the population is accelerating, and the demand for artificial mouths among the elderly is increasing.

- The improvement of the medical system in developing countries has led to an increase in the demand for stoma.

- Ostomy Products continuously upgrades and innovates its research and development materials and technologies.

- The concept of Ostomy care has been continuously strengthened, and the demand for ostomy products has increased.

Concentration and characteristics of the Ostomy Products Manufacturing Market

Market Concentration:

The world’s top four leading enterprises are mainly Coloplast, Hollister, ConvaTec, b. Braun, etc. CR4 is close to 65%-70%. Its main features include high product barriers. The stability of the supply chain is highly demanded. The clinical verification cycle is long. The main channels are hospitals, pharmacies and home care institutions. The end customers have extremely strong stickiness and have long relied on the same brand.

Regional concentration:

- North America and Europe: They are the main demand areas: Medicare reimbursement in the United States promotes the use of high-end products. The ostomy nurse system in Europe is mature and has a high brand loyalty

- Asia-pacific region: Fastest growth rate (CAGR > 7%). The education of ostomy patients in China and India has improved, and the demand for ostomy bag has increased. Asian OEM factories are gradually upgrading their quality grades

Manufacturing Concentration:

The manufacturing end is different from the brand end. The concentration of the manufacturing end is much lower than that of the brand end. European and American brands lead the research and development and high-end finished products. However, a large number of components, stickers, colloids and bag body processing have gradually been transferred to Asian manufacturers.

Product Insights of Ostomy Products Manufacturing

1. Ostomy Products Types:

- One piece ostomy bag: The skin barrier is inseparable from the ostomy bag. It is light, thin and comfortable, and easy and quick to operate. Overall replacement and disposal.

- Two piece ostomy bag: skin barrier is separated from ostomy bag. The Skin barrier can be adhered around the stoma for multiple uses by simply replacing the bag body. There is no need to frequently tear the skin barrier to stimulate the skin, which is more optimized for the skin.

- Drainable ostomy bag:The bottom drain outlet can be used to discharge the feces inside the bag. After being emptied, it can be reused without frequent replacement, which is more economical and practical.

- Closed-end ostomy bag:No discharge port, for single use only. More hygienic and convenient.

- Urostomy bag: Only collects urine. It can prevent urine reflux, reduce hydronephrosis and infection problems. At the same time, it protects the skin from the continuous contamination and irritation of urine.

2. Ostomy Products Manufacturing Materials:

- Ostomy bag film:Various composite films such as PE, EVA,PA,EVOH,PVDC, etc.

- Skin barrier: CMC, pectin, gelatin, butyl rubber and other materials.

- Connecting ring (double-piece type) : PP,PE.

- Flange Activated Carbon filter:Activated Carbon,PET, non-woven fabric coating layer.

- Closure System:Velcro,Clamp, heat-sealed folding structure.

Application Insights of Ostomy Products Manufacturing Market

- Colorectal cancer:Colorectal cancer can cause intestinal stenosis or even complete obstruction, requiring the removal of the rectal lesion to establish a permanent stoma.

- Inflammatory bowel disease (IBD) :such as Crohn’s disease, ulcerative colitis, etc., these diseases can cause repeated inflammation, ulcers and even gastrointestinal perforation.

- Intestinal obstruction:If acute intestinal obstruction caused by inflammation or tumor temporarily makes the patient’s intestine unusable, a temporary colostomy is required, and a temporary colostomy bag should be used to prevent intestinal perforation.

- Intestinal damage caused by trauma: such as car accidents, knife wounds, gunshot wounds, etc., prevent the injured area from being further contaminated and deteriorated. Colostomy is needed to bypass the damaged area to allow it to rest and heal.

- Congenital malformations: such as congenital megacolon, congenital anal atresia, and the inability of newborns to excrete feces normally. colostomy surgery intervention is needed to help restore excretory function.

Annual incidence estimates of IBD in different regions

The global incidence of IBD shows significant regional differences, with the highest in North America and the fastest growth in the Asia-Pacific region. For specific data, please refer to the following content

- North America:The incidence rate in the United States is 150,000 to 300,000 people per year, and in Canada it is 200,000 to 250,000 people per year.

- Europe: The annual incidence rate is 150,000 to 250,000 people in Northern Europe, 100,000 to 150,000 people in Western Europe, 50,000 to 100,000 people in Southern Europe, and 30,000 to 80,000 people in Eastern Europe.

- Asia Pacific:The incidence rate is 10,000 to 30,000 per year in China, 10,000 to 20,000 per year in Japan, and 20,000 to 40,000 per year in South Korea.

- Middle East:The incidence rate in the Gulf countries (Saudi Arabia and the United Arab Emirates) is 30,000 to 60,000 people per year, and in Israel it is also 30,000 to 60,000 people per year.

- Latin America: The incidence rate in Brazil is 30,000 to 50,000 per year. The incidence rate in Argentina is 20,000 to 40,000 per year, and in Mexico it is 10,000 to 30,000 per year.

- Africa:The incidence rate is 10,000 to 30,000 people per year.

Ostomy Products Manufacturing Market End-user Insights

- The patient himself: Mainly concerned about the comfort, privacy, ease of use, bag changing frequency, odor control and other performance aspects of the ostomy bag.

- Family caregivers: focus on safety, simplicity of bag changing operation, availability and cost of disposable accessories.

- Medical professionals:Focus on clinical safety, skin compatibility, complication rate (dermatitis, leakage), product clinical evidence and trainability.

- Long-term care/elderly care institutions:Preference for systems that are highly durable, easy to care for, require few replacements, and have controllable costs.

- Procurement/Distribution (Hospital procurement, medical device distributors, medical insurance system) : Focus on price, supply stability, compliance certificates and reimbursement policies.

Geographical Regional Insights of Ostomy Products Manufacturing Market

1.Overall regional analysis:

- Mature markets (North America, Europe) :High unit price and high penetration rate of high-end products. The reimbursement system supports a high willingness to pay. The brand concentration is high, such as Coloplast, Hollister, ConvaTec, etc. It is recommended to enter the market with high-quality or differentiated products and compliance certificates. Or it is suggested to adopt the OEM/ODM + local distribution partner model.

- Emerging markets (Asia-Pacific, Latin America, the Middle East) :High growth rate, but low unit price/gross profit. Users are sensitive to cost-effectiveness and localized services, while healthcare, education and logistics are the main obstacles. It is necessary to pay attention to cost control, invest in educational support, and at the same time localize packaging. It is suggested to open up the market with accessories or standard ostomy bags, and then launch the high-end series.

2.Specific regional analysis:

- North America (United States/Canada) :Patient education is well-developed, home care services are mature, and medical insurance/reimbursement promotes the adoption of high-performance products. There are high requirements for supply compliance (FDA, USP materials) and clinical data.

- Western Europe/Northern Europe:The stoma care system is mature, stoma nurses have a significant influence, and centralized procurement is common. Acceptance of sustainable materials and eco-friendly packaging is on the rise.

- China & India:IBD growth rate is fast (rising from a low base), and price competition is fierce. However, it has strong manufacturing capabilities and many OEM opportunities.

- Latin America/Middle East:Limited by medical insurance coverage, but with the growth of private market and home care demand, distribution networks and local certifications are key.

Trends and Insights of the Ostomy Products Manufacturing Market in the United States

1. Overall trend

- Reimbursement and medical insurance policies still dominate procurement decisions: Medicare coverage and guidelines directly affect the adoption rates in the hospital and home markets.

- Ostomy products Upgrade and Innovate: Centered on patient experience, upgrade and innovate differentiated products ostomy products.

- Strengthening the role of nursing staff: Stoma nurses have a significant impact on brand selection and patient follow-up use. Manufacturers need to win trust through KOL collaborations and clinical evidence.

- Remote and home care support growth: The importance of remote care capabilities and home supply has increased, and manufacturers have enhanced stickiness through subscription-based supply (regular delivery) and digital tools.

2. Competition concentration

The US market is highly concentrated in brands. The dual challenges for new entrants are the concentrated purchasing by hospitals and the annoying brand loyalty and dependence of patients. For small and medium-sized manufacturers, the goal should focus on differentiated accessories or doing OEM with large brands.

3. Compliance of qualification certificates

The FDA has strict regulations on the classification and material supervision of medical ostomy devices. Any new material or functional claim requires clinical or equivalence verification. Compliance with qualification certificates is a key factor in entering the US market.

The latest progress of the Ostomy Products Manufacturing Market in the United States

1. Value-oriented procurement has been enhanced

More and more medical insurance and large-scale health systems are adopting value-based procurement. Not only should the unit price of ostomy products be considered, but also the rate of complication reduction and the repurchase rate of patients should be given more attention. Ostomy products manufacturing suppliers need to prepare RWE and cost-benefit data in order to enter medical insurance and large health systems.

2. Subscription model expansion

Ostomy products manufacturing supplier collaborates with the DTC channel to provide monthly delivery and care support services, enhancing patient retention and reducing the burden on hospitals.

3. Clinical evidence

If New ostomy products wants to obtain hospital channels, it must provide clinical trials led by stoma nurses or large-sample observational data (infection rate, skin complications, patient satisfaction).

4. Small innovative companies are emerging actively

Small companies conducting experiments in the fields of materials and intelligent monitoring are often absorbed by large medical device companies through mergers and acquisitions during their mature stages, indicating that mergers and acquisitions are the norm in industry layout.

FAQs about Ostomy Products Manufacturing Market

Q1. What is the projected size and growth rate of the ostomy products manufacturing market?

The global ostomy products manufacturing market size: approximately 4 billion US dollars in 2025. In 2030: It is expected to reach 4.5 to 5 billion US dollars

Compound growth rate from 2025 to 2030: approximately 4.5% to 6.8%

Q2. What are the key factors driving the growth of the ostomy products manufacturing market?

- The incidence of intestinal diseases such as inflammatory bowel disease (IBD) and colon cancer continues to rise.

- The aging of the population is accelerating, and the demand for artificial mouths among the elderly is increasing.

- The improvement of the medical system in developing countries has led to an increase in the demand for stoma.

- Ostomy Products continuously upgrades and innovates its research and development materials and technologies.

- The concept of Ostomy care has been continuously strengthened, and the demand for ostomy products has increased.

Q3. By application field, which market segment will dominate by 2030?

The Colostomy market will dominate.

Colon cancer remains one of the most common malignant tumors of the digestive system worldwide. The number of patients with colostomy is much higher than that of patients with ileostomy and urostomy. Colostomy has a long usage cycle and a relatively high annual repurchase frequency. In North America/Europe, more than 50% of stoma surgeries are associated with colon diseases. It is expected that the colostomy market segment will still account for about 40% to 45% by 2030.

Q4. Which region has the highest market share of ostomy products manufacturing?

North America (the United States and Canada) holds the largest market share.

Due to the support of Medicare and Medicaid in North America, the coverage of medical reimbursement is high. The patient has a strong concept of stoma care. The demand rate for high-end products is high. WOC Nurses mature. Therefore, North America consistently accounts for 35% to 40% of the global market share.

Q5. What’s the leading ostomy products manufacturing supplier

- Zodelo (China):Professional and flexible customization, strong technical research and development capabilities, factory wholesale prices.

- Coloplast (Denmark) : Renowned for the SenSura Mio series, emphasizing skin fit and comfort; Clinical standardization and high trustworthiness.

- Hollister (USA) :A century-old brand, leading in patient education

- ConvaTec (UK) :With years of clinical experience, its products are widely used in hospital channels.

- Braun (Germany) : Precision manufacturing and high-end medical systems

Q6. Which is the fastest-growing region in the ostomy products manufacturing market?

The Asia-Pacific region is the fastest-growing area.

The incidence of IBD (Inflammatory Bowel Disease) has been rising rapidly in populous countries such as China and India. The number of stoma surgeries is constantly increasing, and the demand for ostomy bag is also growing rapidly. The improvement and strengthening of the stoma care concept for patients. It is expected that the compound annual growth rate from 2025 to 2030 will exceed 7%, significantly higher than the global average.

Summary - Ostomy Products Manufacturing Market

Zodelo analyzes the global ostomy products manufacturing market and provides qualitative and quantitative data on the current market dynamics. The report explores the current and future potential of the market and analyzes the competitive landscape. This report segments the market by Ostomy Products type, material, region, application and end user.

This report analyzes the regions of North America, Europe, Asia-Pacific, Latin America and the Middle East and Africa (MEA). The report finally analyzed the major companies in the market and their products and services. The data takes 2025 as the base year and also makes predictions for the period from 2025 to 2030.

Get our product catalog or request an instant quote to elevate your business.

More Resourses:

- Disposable Ostomy Bags: Global Market– bccresearch

- Ostomy Care And Accessories Market (2025 – 2030)– grandviewresearch

- Ostomy Care And Accessories Market Research, 2030– alliedmarketresearch

- Ostomy Care Market Size & Share Analysis – Growth Trends & Forecasts (2025 – 2030)- mordorintelligence

- Ostomy– clevelandclinic

- Top 10 Colostomy Bag Manufacturers And Suppliers In China 2026– zodelo

- Top 10 Colostomy Bag Manufacturers And Suppliers In The World 2026– zodelo

Top 10 Urostomy Bag Brands in 2026

Top 10 Urostomy Bag

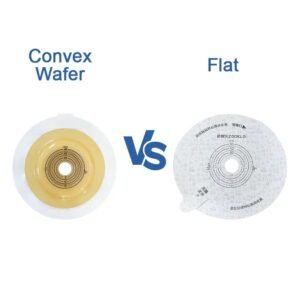

Convex Wafer vs Flat: What’s the Difference

Convex Wafer vs Flat

Top Ileostomy Bag Brands in 2026

Top Ileostomy Bag Br

Ostomy Paste vs Ring: What’s the Difference

Ostomy Paste vs Ring